Amending invoice

Amending invoices are documents that can be used to correct existing invoices that have already been issued.

The reason for the amendment can be several:

- to correct an incorrect amount or quantity,

- to add additional information to the original invoice,

- or a date is wrong.

The amending invoice always refers to an original invoice and modifies its data content as defined in the Hungarian VAT Act.

It is important to know that when an invoice that has already been issued is amended (corrected), a completely new and separate invoice is not created, as in the case of cancelling invoices, which invalidates the original invoice, but by correcting the data, a new invoice can be created that refers back to the incorrectly created invoice. The two invoices - the original, i.e. now modified, and the new, i.e. amending, invoice - are only valid together, since for accounting purposes the two invoices and their respective items are entered in the accounts together.

The original invoice that can be modified, i.e. the document already called modified after a modification, is indicated by a dark blue "M" at the beginning of the relevant line in the invoice list.

The amending invoice, which is used to modify an invoice that has been modified, is indicated by a light blue 'M' at the beginning of the relevant line in the invoice list.

Creating an amending invoice

You can issue an amending invoice from the invoice list in the Finance module of the system.

Only the original invoice (called "amended" after modification) can be modified. An original invoice can be modified almost infinitely.

The way to issue an invoice is as follows:

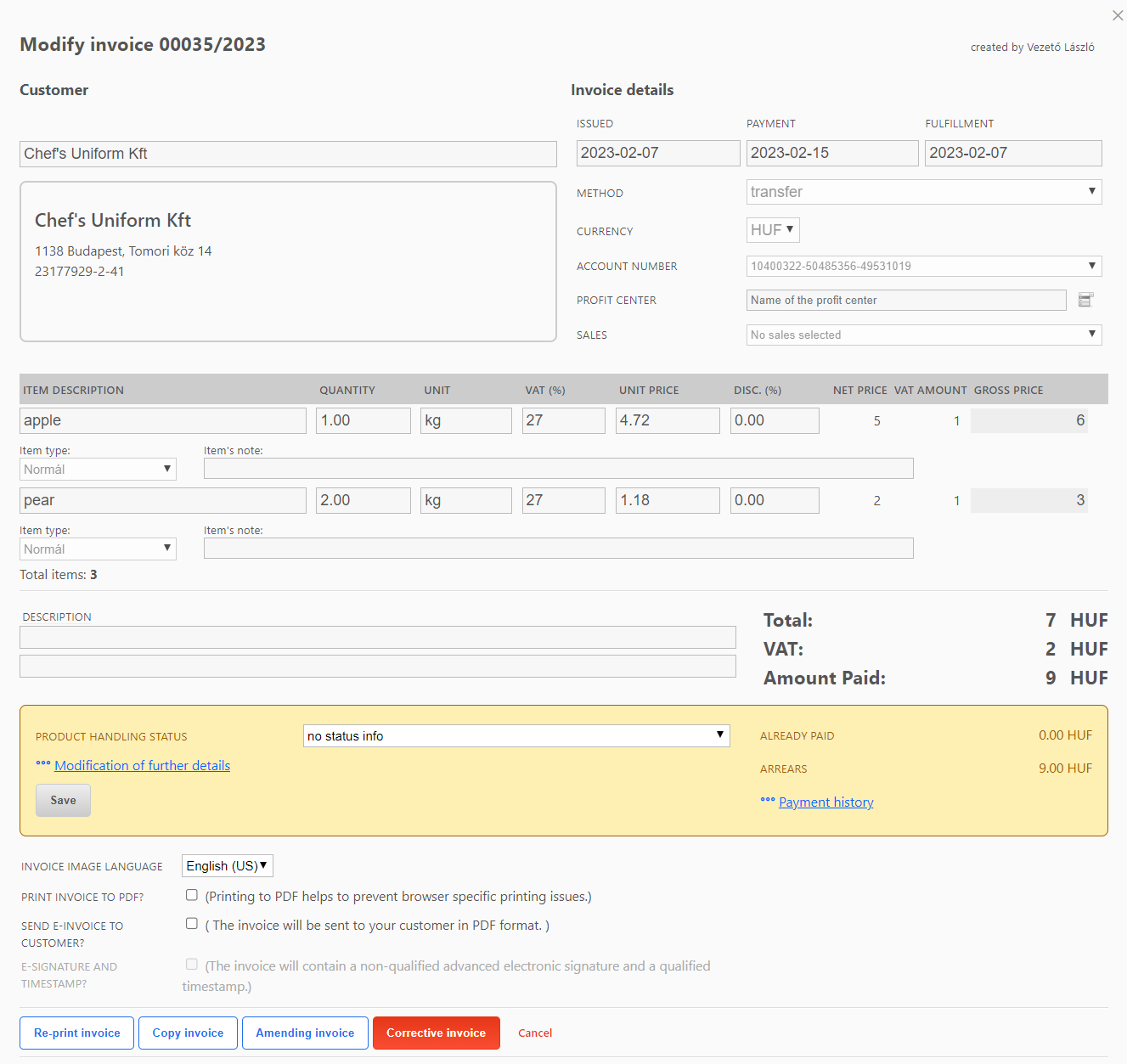

- Select the invoice to be modified, which has already been assigned a serial number but has not yet been cancelled. This will be (after the amendment) the amended invoice. The "Amending invoice" button at the bottom of the amending invoice will start the creation of the modification.

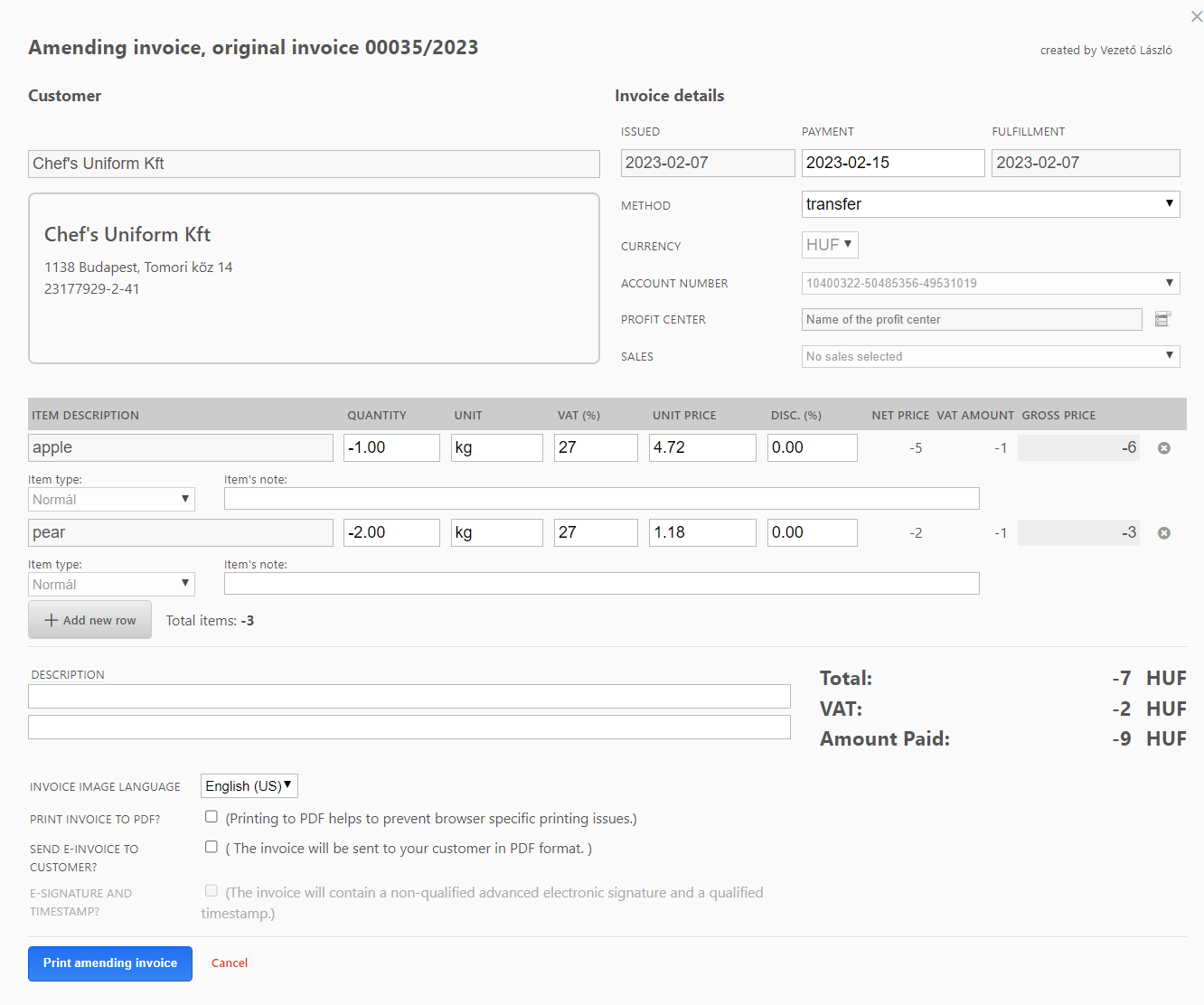

- After pressing the "Amending invoice" button, the appropriate corrections can be set. For example, you can add or remove a new item. Once the appropriate adjustments have been made, the invoice can be finalised at the bottom of the invoice screen by clicking on the "Print amending invoice" button.

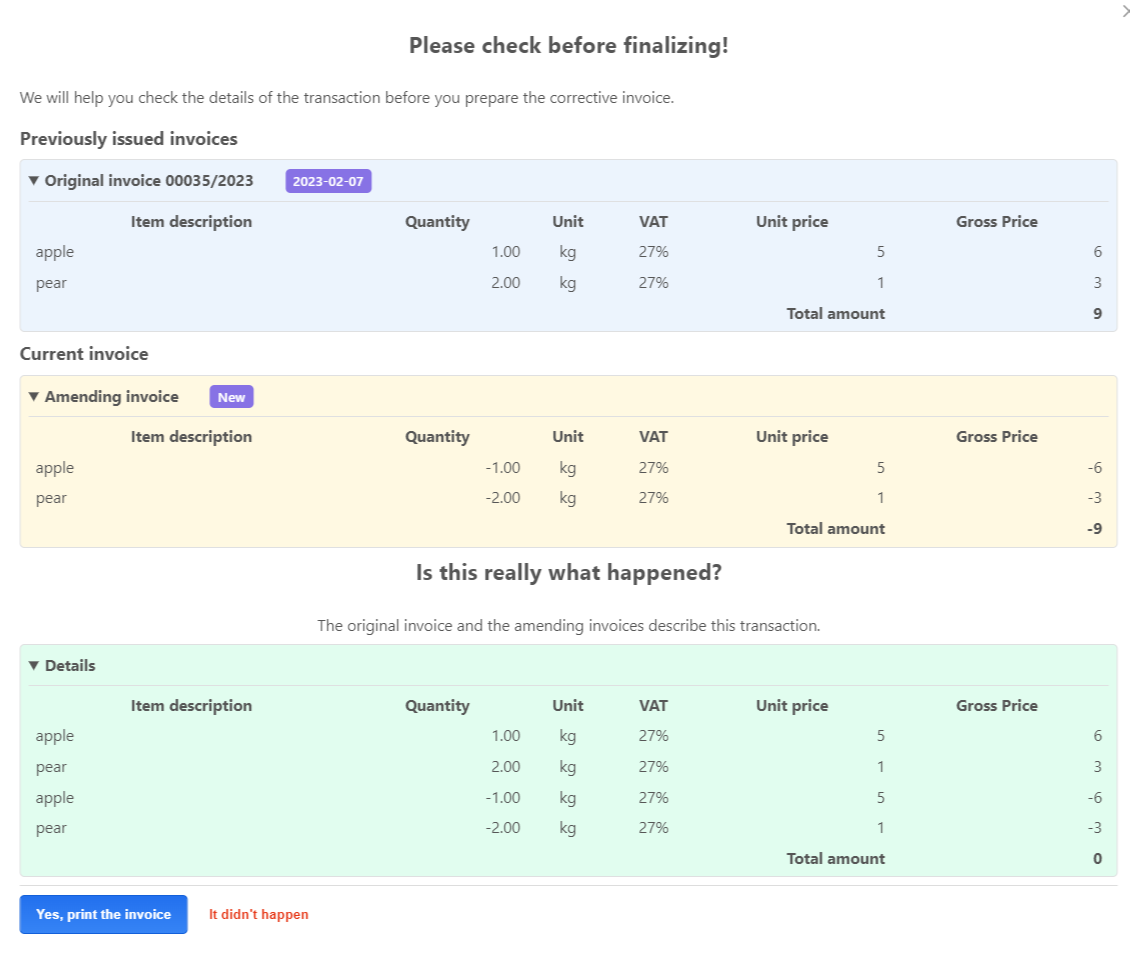

- Before the invoice is actually modified, a check screen will appear, giving an overview of the changes made so far. Here you can see details of previously modified invoices, the current invoice, and the line items. If the information is correct and you want to make changes to the invoice, click on "Yes, print invoice" to accept the changes and the invoice list will show the invoice with the modification, with a light blue "M".

Example of how amending invoices work

The following example is designed to help you understand the amending invoices in the system of CO3.

A customer buys (and pays for) 1 kg of apples and 2 kg of pears. Invoice (original, and later this is the amended one): the seller issues an invoice with the above amounts: 1 kilo of apples 5 $, 2 kilos of pears 2 x 1 $ = 2 $.

The buyer brings back 1 kg of pears from the 2 kg of pears and asks for the price of the pears back. Modification invoice: the seller issues a modification invoice for -1 kg of pears (minus 1 kg). The total amount of the modification invoice is then -1 $ (minus 1 $), which he passes on to the buyer.

In this way, the original invoice is corrected to reflect the actual purchase, since only 1 kg of pears were actually sold. In the case where the buyer buys, for example, 1 kg of plums at the same time as returning the 1 kg of pears, this positive item (1 kg of plums) should also be included in the amending invoice.

Amending invoice check screen

Before an invoice is actually modified, a check screen is displayed which gives an overview of the modifications made so far.

The check screen consists of 3 main parts:

- Previously issued invoices: here you can see all the amending invoices related to an original invoice (with a modified status after the modification). The invoice number and the detailed line items of each invoice are displayed when you drill down to the details.

- Current invoice: shows the content of the current amending invoice.

- Details: the original invoice and all its modification line items.

The verification screen allows you to check the details of the transaction before you create the amending invoice.

Neither amended nor amending invoices can be cancelled.