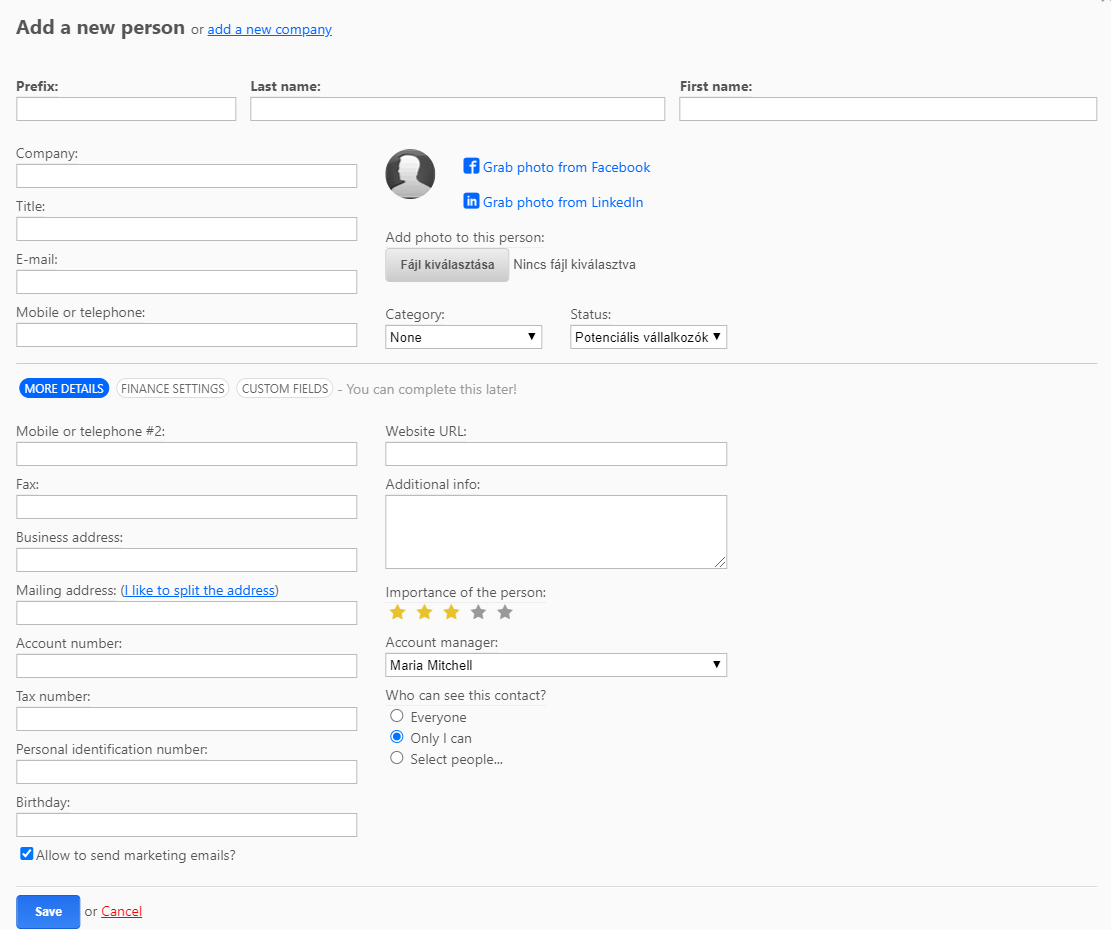

Creating a new partner

You can register a customer, partner, company, acquaintance or even a family member by pressing the "Add Contact" button. It is a good idea to save all details of your new partner for easier future communication. it is definitely worthwhile to record some other important data e.g. billing address,tax number as you will be able to issue an invoice to your partner later, based on the information provided here.

If you only want to register a company, click the "register a new company" link., first click on the “Add Contact” button and then in the pop-up window click the “add new company” link on the top. In this case, the form to be filled in contains only company-specific fields.

You can also add a new company by registering a new partner. In this case, first click on the “Add Contact” button and a company contact will be creating after you have filled the “Company” field on the pop-up window. Later, the registered company name is automatically offered when you start typing the first letters of the company name in the "Company" field. This way you can easily connect new colleagues to your company. When you register a partner, you have the option to upload the partner's photo from Facebook. This feature makes the partner's profile more personal to the user.

You can categorize your customers, or you can set the status of the partner in the sales process in the drop-down Status function. The status given here also shows the status of the partner in the sales funnel.

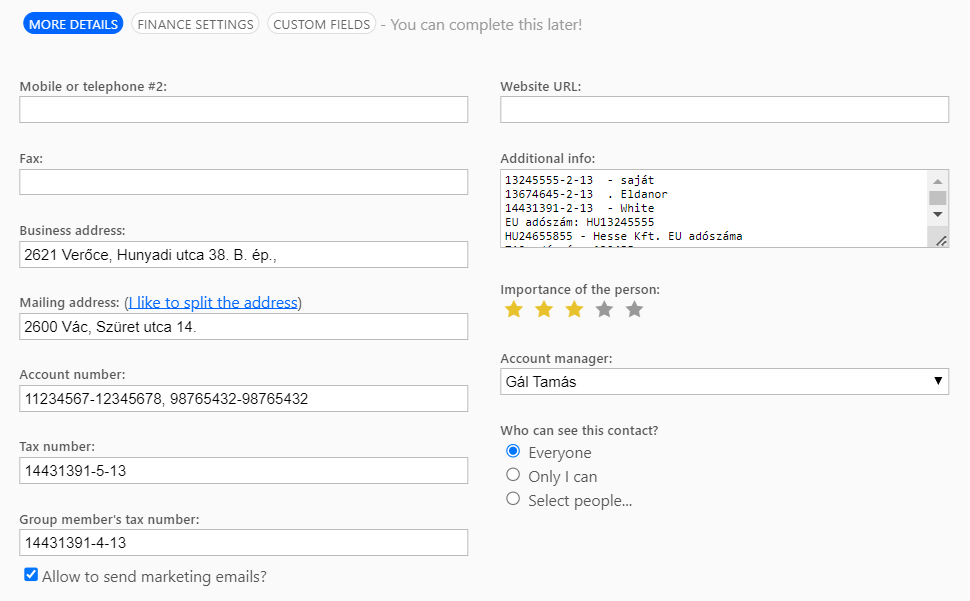

In the Background information field, you can add any additional information that you feel is important and cannot be captured in a separate field. For example: "well paying customer" or "he gets English lessons from us on Fridays ", "vet", etc.

If you check the option to receive a "Marketing email" on the partner's profile, the partner will receive from all outbound marketing emails, whether bulk or unique. Otherwise (eg if it indicating that the partner does not wish to receive emails) when sending the circular, a red message next to the customer's name warns the user that the message cannot be sent to him. Of course, this can be overridden when sending letters, but it is not practical.

By default, the client’s account manager will always be the user who registered the partner. The user who registered the partner can see the partner and set the associated access rights. Of course, Super Admin sees all partners and can override any settings. In addition, he can adjust the visibility in bulk, e.g. even through a search result list for a search. Of course, the client's account manager can be changed at any time. Clients under one account manager may be delegated to another manager in bulk. In the bottom right corner of the partner's profile, under "Who can see this contact?," you can restrict who can see that partner's information.

For companies, it is possible to enter not only an individual tax number, but also a group tax number and a group member tax number. A group tax number is a special tax number in the tax system that can be created by taxable persons established in the country who are jointly connected as an associated enterprise.

If a company has a group member's tax number, that must be entered in the format YYYYYYYY-4-YY in the group member's tax number. The group tax number, in the format YYYYYYYY-5-YY, must be entered in the tax number field. The group tax number will be displayed on the invoice when it is issued until the invoice is serial numbered. After that, both the invoice printout screen and the invoice itself will show the group tax number and also the group member's tax number for the partner.

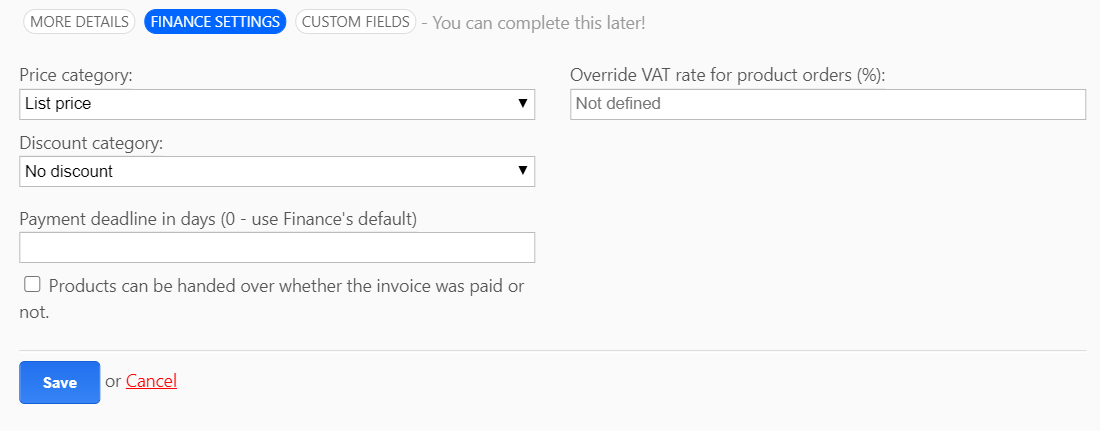

Under Financial Settings tab on the contact’s profile, you can set the partner's price category, the amount of any discount, the partner's payment deadline in days, and whether the product purchased by the partner can be released regardless of the payment of the invoice.

A partner's profile can be modified, and the partner can be deleted at any time.

Deleting a partner will not be allowed if an invoice or warehouse receipt is already attached!